A couple weeks ago Google acquired data analytics company Looker for $2.6 billion.

Google acquired YouTube back in 2006 for $1.65 billion. Core internet services seem bargain bin relative to the valuations of anything with a bit of cloud pixie dust poured upon it.

Salesforce paid about 40x projected forward revenues when they acquired Tableau at a $15.7 billion valuation in an all stock deal.

The transaction is expected to increase Salesforce’s FY20 total revenue by approximately $350 million to $400 million. This estimate reflects a fair value adjustment to reduce unearned revenue and unbilled unearned revenue by approximately 30%, adjustments related to the combined customer base, and inter-company revenue elimination, as required by U.S. GAAP. FY20 Revenue is now expected to be $16.45 billion to $16.65 billion, an increase of 24% to 25% year-over-year.

…

FY20 non-GAAP EPS: As discussed further below, guidance updates for GAAP EPS for all periods discussed are not currently available and Salesforce expects to provide the applicable updates when the transaction has closed and the purchase accounting has been completed. The acquisition is expected to decrease FY20 non-GAAP diluted EPS by approximately ($0.20) to ($0.22). FY20 Non-GAAP EPS is now expected to be $2.68 to $2.70.

I understand the concept of investing in the future & investing in growth, but paying 40x revenues with stock to lower your earnings power per share about 8% really feels a bit out there to me.

Some business models & businesses simply become outmoded as technology pass them by. But there are still some older first-generation internet companies which could likely get kicked into high gear if they had new management.

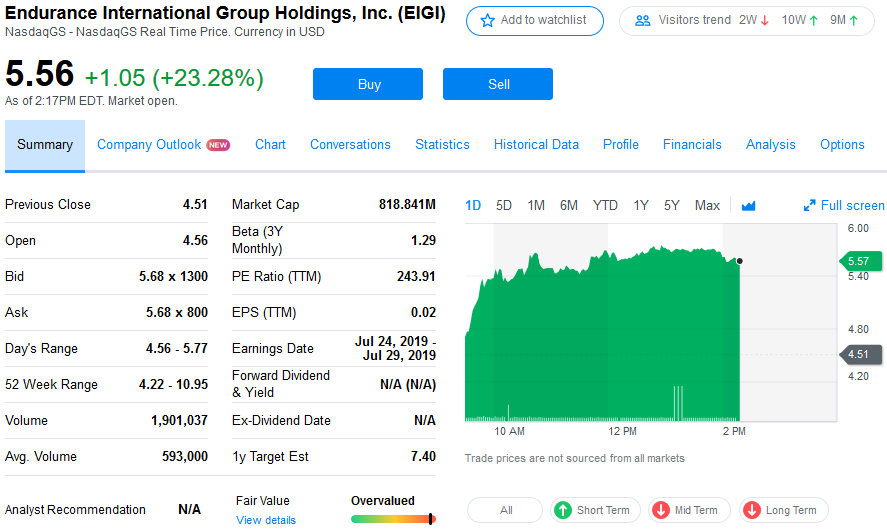

Consider web hosting company Endurance International Group. They are not really growing, but they have a lot of recurring subscription customers & they are valued at far less than 1 times revenues. And that is after their stock had a massive short squeeze today on above 3X normal trade volume.

If you have 10s of thousands or 100s of thousands of hosting clients, how many cross sells (ecommerce shopping cart? security certificates? domain names? domain privacy? email marketing?) or other upgrades (security certificates? enhanced uptime guarantees? premium customer support? premium on-site analytics services? ad management?) do you need to do in order to really turn things around.

The duality in valuations between innovative stories & companies that are not particularly growing has perhaps never been greater.

There are no asset managers who represent their strategy to clients as “We buy the most expensive assets, and add to them as they rise in price and valuation.” That’s unfortunate, because this is the only strategy that could have possibly enabled an asset manager to outperform in the modern era. It’s one of those things you could never advertise, but had you done it, you’d have beaten everyone over the ten-year period since the market’s generational low.

But almost every investment professional says that they do the opposite of this. Even the explicitly growth-oriented managers use terms like “at a reasonable price,” to communicate their place on the spectrum of speculative chastity. There are no textbooks lauding an investment approach where it makes more sense to buy PayPal at 4 times book on its way to 9 times book while forsaking Goldman Sachs at less than 1 times book.

…

In the battle for capital right now, the brands and intangibles and user bases and networks are winning by a landslide against the things that used to be important. And the companies that are rich in those old fashioned things, like Walmart, Disney and McDonalds, are spending all of their time and attention to transform themselves into the spitting image of their upstart competitors. Disney wants to look like Netflix, Walmart wants to retail like Amazon, McDonalds wants to be as habit-forming and celebrated for its freshness as its former protege Chipotle is. Goldman Sachs wants to grow up to be BlackRock. And in emulating these younger models, they hope, their multiples will soon be following suit.

Fast-growth money losing online retailer of pet foods Chewy (CHWY) raised about $1 billion in an IPO that valued them at about $9 billion. And that is a literal modern analog to Pets.com. Except it also has a dual class share structure where insider shares have a 10:1 voting advantage. And, of course, the market ate it up with shares trading up 60% on the first day, giving them an enterprise value of just under $14 billion.

in the most recent fiscal year, Chewy notched a 68% y/y growth rate in revenues, but still found itself with a -$268 million loss

Two analogs for pondering the valuation of Chewy…

- Online pet medicine retailer Petmed Express isn’t really growing & has perhaps been driven down quite a bit over the past year as it has competed against the ad budget of Chewy. Anyhow, PETS has a market cap of $351 million, no debt, an enterprise value of $251 million after subtracting cash on the books, a P/E of 9.6, an enterprise value to sales ratio below 1, and a 6.14% dividend.

- Kroger (KR) is the leading pure-play grocery store across the United States. Their market cap is under $20 billion & their enterprise value is under $35 billion.

Going back to the cloud & internet services for a moment, there is a massive duality in how things are priced. Cell tower REITs like American Tower (AMT), Crown Castle (CCI) & SBA Communications (SBAC) trade like we are going to increase data usage 5-fold annually for the next couple decades. The REIT cell tower plays give dividend value investors at least a bit of cash they throw off, but then they also sell the narrative of perpetual geometric growth.

Telecom players like AT&T (T) or Verizon (VZ) which license the services of the above REITs are viewed as dinosaurs allergic to innovation, with steep dividends & large debt service costs that prohibit innovation.

Is it certain FANG will keep eating most the enterprise value growth as the web continues to grow?

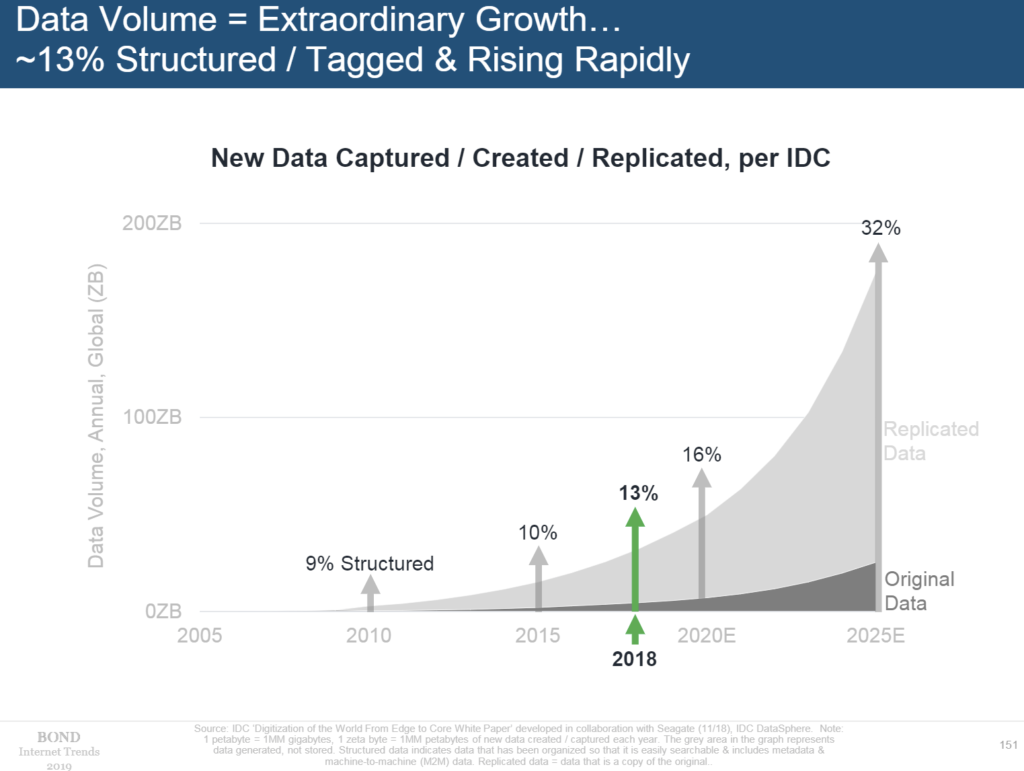

And then with all the data we are creating it has to be stored somewhere. Its in the cloud. Ok, but on what? Still mostly on hard drives, because replicating data across multiple of those is far cheaper than putting everything on flash drives. Western Digital (WDC) is valued at under $11 billion & is worth about 45% of their 52-week high. Seagate (STX) is valued at around $12 billion.

I have been more than a bit overwhelmed with the web recently, so haven’t been trading as much as I did a few months back, but I did trade in and out of both WDC & STX early in the day for small wins. Segate was down a couple percent early in the day & now it is up about a percent. I still have a small position. And as a bonus, tomorrow they go ex-div, so that’s another percent and change. 🙂