Last year’s sell off was relentless. Even trades that had long bases & were overly obvious still cratered with the broader market. No matter what you were in, if you were in almost anything (other than a short position) you were virtually guaranteed to lose as asset prices deflated.

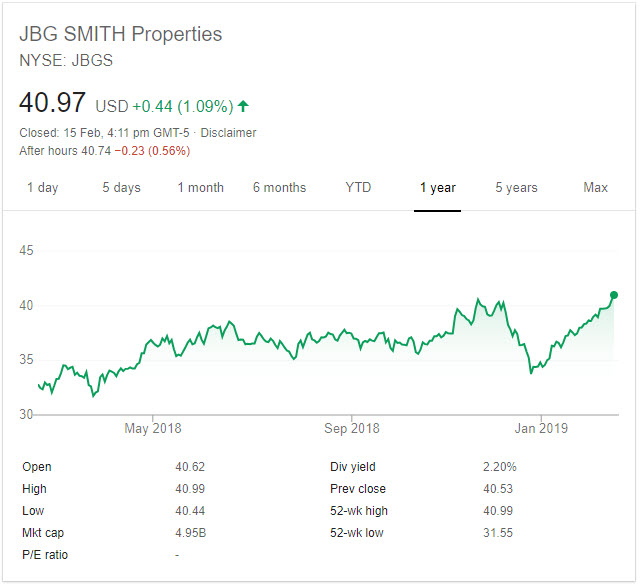

Amazon.com announced they were nixing their New York City HQ2, and would grow their other locations instead. JBG Smith Properties (JBGS) instantly jumped on the news & is making fresh all-time highs.

Since December 24th much of the market has seen a relentless bid higher. Enterprise software is up, game makers up even after weak performance, REITs & many other bond proxies near 52-week highs, gold strong even as the Dollar has been strong, oil prices recovering, the Nasdaq has entered a new bull market, etc.

Some individual names have recently bombed though:

- Mattel slid the most in decades

- Coca-Cola fell over 9% in 2 days, losing around $20 billion in market cap, in their biggest daily decline since 2008

- Newell Brands fell 20.89% yesterday after forecasting their revenues will decline this year

Even some companies which reported strong results have seen shares slide. Yandex (YNDX) slid 8.54% yesterday & their conference call didn’t sound particularly horrible. Their ride sharing is already profitable if you back out self-driving & food delivery, they are likely to benefit from the hype cycle around the Lyft & Uber IPOs, they are still projecting search revenue increases of 18% to 20% this year, and while they saw rising TAC it was due in part to them gaining search marketshare on Android devices.

The above being stated, Yandex was as low as $24.90 on October 19 last year on rumor they could get acquired by Sberbank & they are now down to $31.47, so that is still a big 26.4% jump off those lows.

Part of the recent bullishness is alleged positive trade talks with China. But ultimately Trump has zero incentive to quickly solve the trade war stuff, because once it is over & people do not have some gain to look forward to & they realize their lives haven’t improved much he can’t use that narrative to drive re-election. So he is going to have to drag the trade war stuff out for at least another year & some of that will be via significant headline risk.

Now there is sort of a bullish mindset across the markets & maybe it holds, but I recently bought a bit of Virtu (VIRT) in case it doesn’t & those sort of one-off edge case slides start to spread throughout the market.

Central banks have been stocking up on gold while CLOs are the new CDOs & MMT is getting lots of love

If I am correct, I suspect we will see many Democrat candidates (perhaps all?) adopt MMT as a tenant of their platform. And here is a crazy thought for you – what if Trump beats them to it?

…

Although I don’t have any concern about the government funding itself, I do have lots of worry that inflation would quickly rise and before too long, the government would be forced to cut back its spending, and that typical of governments, it would prove much more difficult than instituting spending. Therefore I would expect fixed-income to be a terrible investment under MMT. Even if the government pegs rates low, inflation will be the real risk. It would make little sense to sit in an asset that pays fixed.

Add to that a record selling of U.S Treasury bonds by foreigners:

Foreigners sold $77.35 billion in U.S. Treasuries in the month, after net sales of $13.2 billion in November. December’s outflow was the largest since the U.S. government agency started recording Treasury debt transactions in January 1978.

And a more symmetrical view of promoting inflation:

“I think the Fed is going to change that policy subtly over time,” Dudley said. “They are going to talk about, ‘We want to hit 2 percent inflation on average.’ And that’s going to imply to people that if they miss on the low side for a while, that they’ll be willing to miss on the high side for a while.” – former New York Fed President William Dudley