A Rather Uneducated Opinion on Education Software

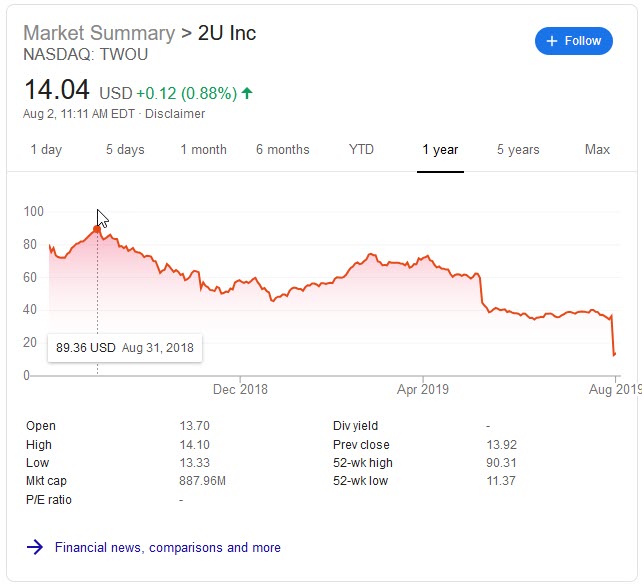

Before the market started falling apart late last year on the Fed’s narrative of rate & balance sheet normalization online education company 2U (ticker TWOU) was trading above $90 a share. As the market broke, so did the stock.

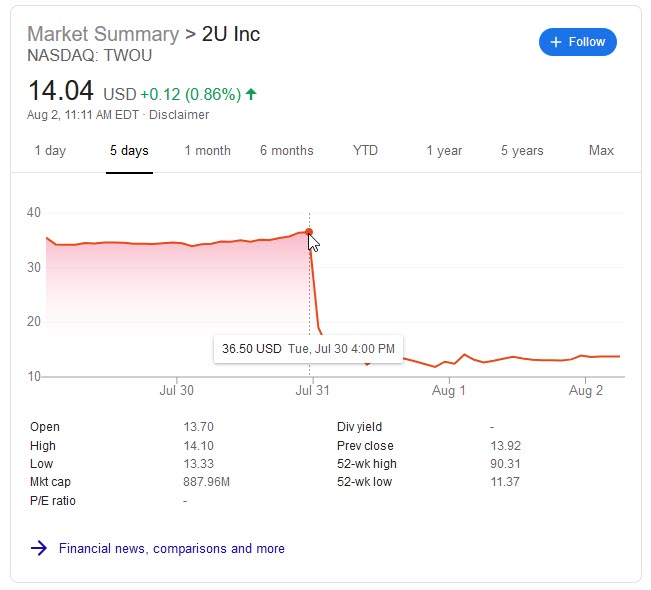

It lost nearly 2/3 of its market cap leading up to its most recent earnings announcement & then it lost nearly 2/3 of its remaining market cap after the ugly announcement with weak guidance which included announcing a business model shift to allow pay for service fees versus sticking to a percent of revenues business model & slower course roll out.

The core business for 2U — helping selective institutions such as the University of Southern California launch large online graduate programs — isn’t growing as hoped. With the “mainstreaming of online education,” attracting large numbers of students to a particular online program is more challenging and more expensive than it was just a few years ago, said Paucek.

To adapt, the company is planning to significantly slow down the number of new graduate programs it launches, said Paucek. It also plans to make its online programs smaller than they were in the past. “By lowering enrollment expectations, we expect a more efficient marketing spend over the long term,” he said.

The above sort of 1/3 of 1/3 – a move from above $90 to $11 and change a share – is the sort of price trend you might expect with like an Enron stock or perhaps a JC Penney trying to draw inspiration from the Sears playbook.

That move marks an extreme in sentiment as at the core 2U is an enterprise software company tied to education. There has certainly been slowing growth & negative press tied to USC, but is the company worthy of the decline they just saw? I am skeptical & have been trading in and out of the stock a few times over the past couple days. If it goes down much more I would be fine holding it figuring it is fairly derisked at current prices, but the regular 3% to 5% swings make it easy to make a bit of profit going in and out of it.

Another online education company Pluralsight did a sweet -40% swan dive after reporting their quarterly results.

Fed Funds Rates, Trade & Tariffs

After the Federal Reserve lowered rates a quarter point & halted quantitative tightening Trump was quick to lay on the next round of tariffs on China (10% on the $300 billion in remaining Chinese imports), giving the stock market a big & beautiful kick to the nuts. Supply chains are being reoriented away from China through Vietnam (though some of that might be Chinese misdirection via repackaging) & Mexico.

U.S. imports from China fell 12% in the first six months of 2019 from a year earlier, while exports fell 19%, the Commerce Department said Friday in a monthly trade report. The total value of bilateral goods trade with China, at $271.04 billion in the first half of the year, fell short of that with Canada and with Mexico for the first time since 2005. Mexico is now the U.S.’s top trading partner. … China’s share of the U.S. market is on pace to fall to its lowest level since 2008. The East Asian nation accounted for 13.2% of total trade in goods—imports plus exports—in the first half of 2019, Friday’s data show, behind Mexico with 15% and Canada at 14.9%.

A glut of bonds will soon hit the market as the new and improved (deproved?) budget will help blow out annual deficits by an additional ~ 1/3 trillion.

Eating Well…

Somehow in spite of the ugly tape I’ve done well over the past couple days largely by being fairly light on exposure, opportunistically trading in and out of positions, and even one of my bigger holdings that has been weak for a while just got a nice upgrade from Pivotal Research analyst Ajay Jain, causing Kroger (KR) to jump over 3%.

Kroger stock has fallen nearly 26% in the past year and is down more than 19% in 2019 alone, a period that’s seen the S&P 500 rise by nearly as much. The company delivered decent earnings at the end of June, raised its dividend, and insiders are buying the shares. Yet those factors have done little to overcome the general fear about intense competition in the supermarket space.

Kroger’s market cap is about $18 billion while their enterprise value is about $38 billion. They sell north of $100 billion in groceries per year. Outside of Walmart & Target most of their competitors are heavily debt-levered by private equity in a way that prohibits investment in growth or running a sustainable business while serving the debt payments on debt mountains.

Now Serving Only The Finest of Fake Meats…

Grocery Outlet (GO) recently went public & has an enterprise value to sales ratio of 1.9 compared to Kroger’s 0.3. Beyond Meat (BYND) is valued at over $10 billion after their recent fall which was driven in part by the record speed of their secondary offering after their large pop from their IPO.

If the segment of the consumer population that shops at Grocery Outlet (T.J. Maxx of grocery stores) continues to grow then one is basically betting on full on feudalism which would likely lead to anarchy and a sell off of financial assets. And fake meat is basically dog food. Other than as a short-term trade I don’t know why anyone would prefer either of those to Kroger.

For anyone who likes Beyond Meat here & has a bit of FOMO to feed, feel free to watch this hot take …

… and then check out how Beyond Content (formerly Demand Media, now Leaf Group) has done since their much hyped IPO.

I think CNN had the best hype on that pump-n-dump scam:

Demand Media shares soar 33% in IPO

Shares ended at $22.65 Wednesday, after touching a high of $25.

That gives Demand a valuation of $1.5 billion — more than the New York Times Co., though less than other media stalwarts like Gannett Co. and Washington Post Co.

That’s also the highest market capitalization for an Internet company since Google‘s IPO in 2004, according to research firm Renaissance Capital.

Nice framing there. Demand Media as the next Google.

Was CNN Money on the money?

Hrm…

General Thoughts

As long as there is more volatility throughout the day & everything is flying around I try to end the days with few sizable positions and am willing to take a hundred here & a few hundred there. Making a grand or two isn’t particularly bad in a tape where most are losing that much. But one has to have some liquidity on hand going into the shitty tape in order to capitalize on overshoots.

Funko (FNKO) is off around 8%. I established a position figuring they’ll eventually come back. I also bought a bit of AbbVie (ABBV).

I also have a start up idea based on buying dog food as a source product to create a meat alternative. More on that later tho!